Getting a job at HDFC Bank can be difficult. Many people find the interview questions difficult. They are not sure what the interviewers expect. This makes job seekers worry. They want to know the kind of questions they will face and the best way to answer them.

This article will help you. It has the newest questions from HDFC Bank interviews and answers that will help you do well. Read this and get ready to impress the interviewers and get the job you want.

HDFC Bank Interview Process

Getting a job at one of India’s leading banks can be competitive, but with the right preparation, you can increase your chances of success. Let’s take a closer look at the interview process and what the bank expects from its potential employees.

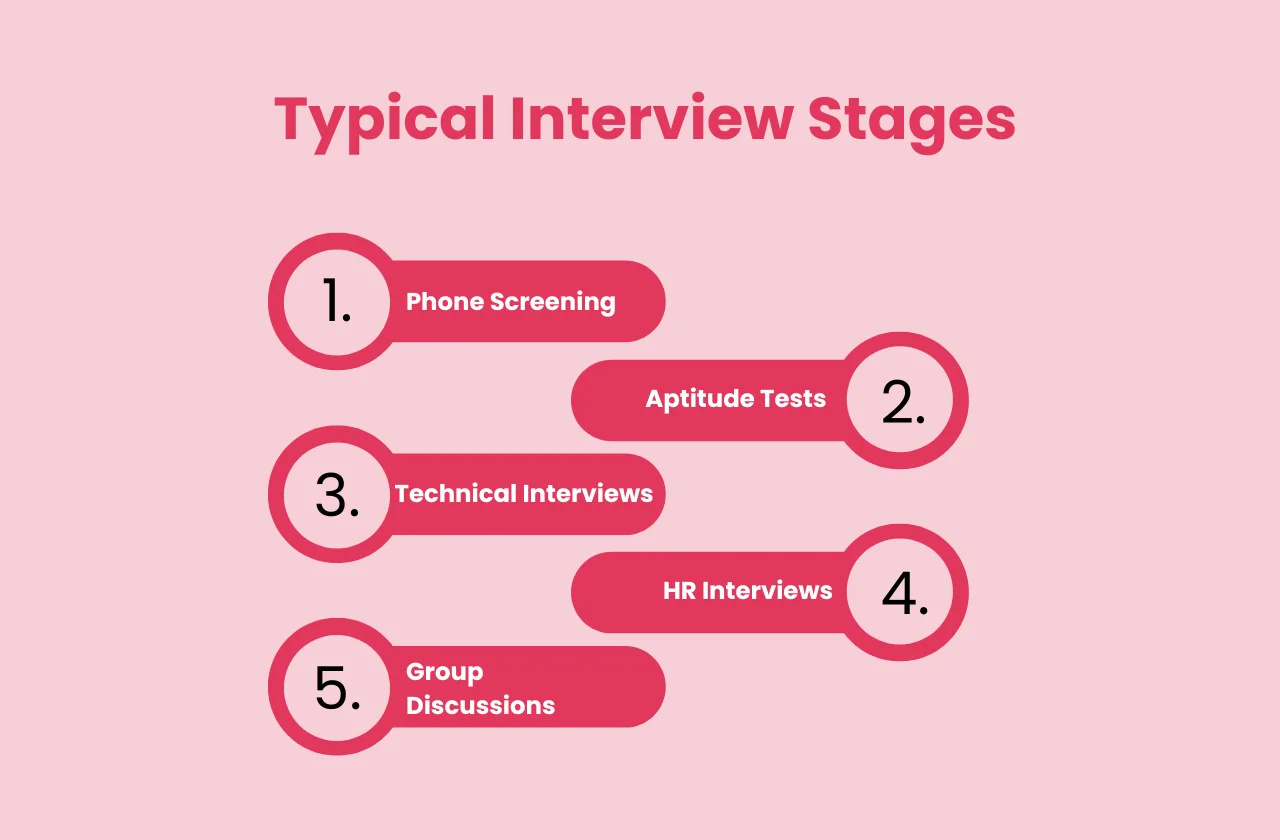

HDFC Bank Interview Stages

The HDFC Bank interview process typically involves several stages, each designed to assess different aspects of your skills and suitability for the role. The specific stages may vary slightly depending on the position you are applying for, but generally, you can expect the following:

Phone Screening: This is often the first step, where a recruiter will call you for a brief conversation. They will ask basic questions about your experience, qualifications, and interest in the position. This stage helps the bank filter out candidates who are not a good fit from the start.

Aptitude Tests: If you pass the phone screening, you might be asked to take online aptitude tests. These tests evaluate your numerical ability, logical reasoning, and verbal skills. The objective is to gauge your general aptitude and problem-solving skills.

Technical Interviews: Depending on the role, you may have one or more technical interviews. These interviews are usually conducted by experts in the specific area you will be working in. For example, if you are applying for a software development position, you might be asked to solve coding problems or discuss technical concepts.

HR Interviews: The HR interview focuses on your personality, communication skills, and cultural fit with the bank. You may be asked questions about your motivations, strengths, weaknesses, and career aspirations. This interview helps the bank assess whether you will be a good fit for the team and the organisation as a whole.

Group Discussions or Case Studies: For some positions, you might be invited to participate in group discussions or case studies. These activities allow the bank to observe your teamwork, leadership, and problem-solving skills in a group setting.

What HDFC Bank Looks For?

HDFC Bank values certain skills and qualities in its employees. Understanding these can help you tailor your preparation and presentation during the interview process.

Customer Focus: As a bank, HDFC’s primary goal is to serve its customers well. Therefore, they look for candidates who demonstrate a strong customer-centric mindset. This means being able to understand customer needs, provide excellent service, and build positive relationships.

Integrity: Honesty and ethical behaviour are essential in the banking industry. HDFC Bank expects its employees to maintain high standards of integrity and adhere to the bank’s code of conduct.

Technical Knowledge: Depending on the role you are applying for, you will need a certain level of technical knowledge. This could be knowledge of banking products, financial regulations, software development, or any other relevant technical skill.

Problem-Solving Skills: The ability to analyse problems, think critically, and come up with effective solutions is crucial in any role at HDFC Bank.

Communication Skills: Effective communication is key to success in any organisation. HDFC Bank looks for candidates who can communicate clearly and concisely, both verbally and in writing.

Teamwork: Most roles at HDFC Bank involve working with others. Therefore, the ability to collaborate effectively with team members is highly valued.

Adaptability: The banking industry is constantly changing, so the ability to adapt to new situations and learn quickly is essential.

Now that you know what happens, let’s look at the types of questions you might get asked.

HDFC Bank Interview Questions & Answers

These are questions you’ll probably hear in almost any interview at HDFC Bank, no matter the job. We give you good answers to help you think about your own.

HDFC Bank Interview Questions: Personal and Motivational

1) “Tell me about yourself.”

Sample Answer: “I am a [Your degree] graduate with [Number] years of experience in [Your field]. I am passionate about [Your passion] and have a strong track record of [Your achievements]. In my previous role at [Your previous company], I was responsible for [Your responsibilities]. I am eager to learn and grow, and I am confident that I can bring valuable skills and experience to HDFC Bank.”

2) “Why are you interested in working for HDFC Bank?”

Sample Answer: “HDFC Bank is a leading financial institution with a strong reputation for innovation and customer service. I am impressed by HDFC Bank’s commitment to digital transformation and its focus on providing a positive customer experience. I believe that my skills and experience align well with HDFC Bank’s values, and I am excited about the opportunity to contribute to the bank’s continued success.”

3) “Why did you choose this specific role?”

Sample Answer: “This role is a great fit for my skills and interests. I have a strong background in [Relevant skills] and I am eager to apply my knowledge to this position. I am also attracted to the challenges and opportunities that this role presents, and I believe that I can make a significant contribution to HDFC Bank in this capacity.”

4) “Where do you see yourself in 5 years?”

Sample Answer: “In 5 years, I see myself as a valuable member of the HDFC Bank team, making significant contributions to the bank’s success. I am committed to continuous learning and development, and I aspire to take on increasing levels of responsibility within the organisation. I am also passionate about mentoring and developing others, and I hope to be in a position where I can share my knowledge and experience with future generations of HDFC Bank employees.”

HDFC Bank Interview Questions: Behavioral

1) “Describe a time when you faced a challenging customer interaction and how you resolved it.”

Sample Answer: “In my previous role, I once dealt with a customer who was upset about a service charge. I listened carefully to the customer’s concerns, empathised with their frustration, and explained the reason for the charge. I offered a solution that addressed the customer’s concerns and ensured their satisfaction. The customer appreciated my willingness to listen and find a solution, and they left the interaction feeling valued and heard.”

2) “Give me an example of a time you had to work as part of a team to achieve a goal.”

Sample Answer: “In my previous role, I was part of a team that was tasked with launching a new product. We had a tight deadline and a lot of work to do. We divided the tasks among ourselves, communicated regularly, and supported each other throughout the process. We successfully launched the product on time and within budget, and we were all proud of our accomplishment.”

3) “How do you handle pressure and deadlines?”

Sample Answer: “I stay calm under pressure and I am able to prioritise tasks effectively. I also have a good track record of meeting deadlines. In my previous role, I was often responsible for managing multiple projects simultaneously. I developed a system for tracking my progress and ensuring that I was on track to meet my deadlines. I also communicated regularly with my manager and team members to keep them updated on my progress.”

Besides these, you’ll also get questions that are more about the specific job. We cover those next.

HDFC Bank Technical Interview Questions

If you’re applying for a technical role, like in IT or finance, expect questions that test your skills and knowledge.

For Relationship Managers: What are the key factors to consider when assessing a customer’s creditworthiness?

Sample Answer: As a relationship manager at HDFC Bank, assessing a customer’s creditworthiness is a crucial task. Here are the key factors to consider:

- Income and Employment: Evaluate the customer’s steady source of income, job stability, and earning potential. This helps determine their ability to make timely loan repayments.

- Credit History: Review the customer’s past credit behaviour, including any defaults, late payments, or outstanding debts. This provides insights into their financial discipline and repayment habits.

- Assets and Liabilities: Analyse the customer’s asset ownership, such as property, investments, or savings, as well as their existing financial obligations. This helps assess their net worth and debt-servicing capacity.

- Cash Flow: Closely examine the customer’s monthly income and expenses to ensure they have sufficient disposable income to service the proposed loan.

- Collateral: Assess the value and liquidity of any collateral the customer can provide, as this can mitigate the bank’s risk in case of default.

- Industry and Market Trends: Understand the customer’s business or industry, including its growth prospects, competition, and regulatory environment, to gauge the overall risk.

By thoroughly evaluating these factors, relationship managers can make informed decisions on the customer’s creditworthiness and tailor loan products accordingly.

For IT Professionals: Describe your experience with specific banking software or technologies.

Sample Answer: As an IT professional at HDFC Bank, I have extensive experience working with various banking software and technologies. Some of the key systems I have worked with include:

- Core Banking System: I have hands-on experience with the Finacle core banking platform, which is widely used by HDFC Bank. I have been responsible for developing, testing, and maintaining various modules within the Finacle system, such as account management, loan origination, and transaction processing.

- Payments and Remittance: I have worked on integrating HDFC Bank’s payment systems with external platforms, such as NEFT, RTGS, and UPI, to ensure seamless and secure fund transfers for our customers.

- Fraud Detection and Monitoring: I have developed and implemented advanced analytics-based fraud detection algorithms to identify suspicious transactions and prevent financial crimes. This involves leveraging machine learning techniques and integrating with the bank’s fraud management system.

- Digital Banking Platforms: I have been involved in the development and enhancement of HDFC Bank’s mobile banking app and internet banking portal. This includes implementing features like account aggregation, bill payments, and loan applications, while ensuring a user-friendly and secure experience.

- Data Management and Reporting: I have experience in designing and maintaining the bank’s data warehouse and business intelligence systems. This allows me to generate comprehensive reports and dashboards to support data-driven decision-making.

Throughout my tenure, I have kept myself updated with the latest banking technologies and industry trends, enabling me to contribute effectively to HDFC Bank’s technological innovations and digital transformation initiatives.

For Operations Staff: How would you ensure the accuracy and efficiency of daily banking transactions?

Sample Answer: As an operations staff member at HDFC Bank, ensuring the accuracy and efficiency of daily banking transactions is of utmost importance. Here’s how I would approach this responsibility:

- Adherence to Standard Operating Procedures (SOPs): I would strictly follow the bank’s established SOPs for various transaction processing tasks, such as account opening, fund transfers, and cash handling. This would help maintain consistency and minimise errors.

- Thorough Verification: I would meticulously verify all transaction details, including account numbers, beneficiary information, and transaction amounts, to ensure the accuracy of the data entered. This would involve cross-checking with supporting documents and customer records.

- Dual Control Mechanisms: I would work closely with my team members to implement dual control mechanisms, where critical transactions are reviewed and approved by a second staff member. This would help in catching any discrepancies or anomalies.

- Automated Reconciliation: I would leverage the bank’s core banking system and other technology tools to automate the reconciliation of transactions, account balances, and cash positions. This would enable me to quickly identify and resolve any mismatches or discrepancies.

- Continuous Monitoring and Reporting: I would closely monitor the daily transaction activities and report any unusual patterns or potential issues to the supervisory team. This would allow for proactive intervention and corrective actions, if necessary.

- Training and Skill Development: I would actively participate in training programs to enhance my knowledge of banking operations, regulatory requirements, and emerging industry trends. This would help me stay updated and adapt to changes in the banking landscape.

By following these practices, I would ensure the accuracy, efficiency, and compliance of daily banking transactions, thereby contributing to HDFC Bank’s operational excellence and customer satisfaction.

HDFC Bank Interview Questions: Industry and Company Knowledge

1) What are the latest trends in the Indian banking sector?

Sample Answer: The Indian banking sector has been witnessing several key trends in recent years:

- Digital Transformation: Banks are rapidly embracing digital technologies, such as mobile banking, internet banking, and artificial intelligence, to enhance customer experience and operational efficiency.

- Financial Inclusion: There is a strong focus on expanding banking services to the unbanked and underserved segments of the population, particularly in rural and semi-urban areas.

- Regulatory Changes: The banking industry is subject to evolving regulatory frameworks, including stricter capital requirements, enhanced risk management practices, and data privacy regulations.

- Fintech Disruption: The rise of fintech companies is driving innovation and competition in the banking sector, leading to the adoption of new technologies and business models.

- Consolidation and Mergers: The industry has seen a wave of mergers and acquisitions, with larger banks acquiring smaller players to gain market share and economies of scale.

- Emphasis on Sustainability: Banks are increasingly incorporating environmental, social, and governance (ESG) considerations into their lending practices and investment decisions.

- Cybersecurity Challenges: Banks are investing heavily in strengthening their cybersecurity measures to protect against the growing threat of cyber attacks and data breaches.

2) What are HDFC Bank’s core values and mission?

Sample Answer: HDFC Bank’s core values and mission are:

Core Values:

- Customer Focus: Placing the customer at the centre of everything we do.

- Operational Excellence: Striving for the highest standards of quality and efficiency.

- Integrity: Upholding the highest ethical standards and maintaining transparency.

- Teamwork: Fostering a collaborative and supportive work environment.

- Innovation: Continuously exploring new ideas and technologies to drive progress.

Mission:

HDFC Bank’s mission is to be the most preferred and trusted financial services provider, delivering superior value to its customers, shareholders, and the community at large. The bank aims to achieve this by leveraging its technological capabilities, product innovation, and deep understanding of customer needs.

3) Who are HDFC Bank’s main competitors?

Sample Answer: HDFC Bank’s main competitors in the Indian banking sector include:

- State Bank of India (SBI): As the largest public sector bank in India, SBI is a formidable competitor with a vast branch network and a strong presence in retail, corporate, and rural banking.

- ICICI Bank: ICICI Bank is one of the largest private sector banks in India, offering a wide range of banking and financial services, and is a direct competitor to HDFC Bank.

- Axis Bank: Axis Bank is another leading private sector bank in India, known for its strong retail and corporate banking offerings, as well as its digital banking capabilities.

- Kotak Mahindra Bank: Kotak Mahindra Bank has established itself as a prominent player in the private banking space, with a focus on wealth management and investment banking services.

- IndusInd Bank: IndusInd Bank has been growing rapidly in recent years, particularly in the areas of retail banking, commercial banking, and transaction banking.

- Yes Bank: Yes Bank is a relatively newer private sector bank that has gained significant market share, especially in the corporate and investment banking segments.

These banks, along with HDFC Bank, compete for market share, customer deposits, and loan portfolios, driving innovation and competition in the Indian banking industry.

It’s not just about what you know; it’s also about how you present yourself. Here are some tips to help you succeed.

HDFC Bank Interview Preparation Tips

Landing an interview at HDFC Bank is a big step in your job search. Here are some easy tips to help you do well and get the job:

1) Research: Get to Know HDFC Bank

- Learn about the bank’s history: When did HDFC Bank start? What are some important things that happened over the years?

- Check out their products and services: What kind of bank accounts, loans, and credit cards does HDFC Bank offer?

- Read recent news articles: Has HDFC Bank been in the news lately? What are they doing that’s new and exciting?

- Visit their website: The bank’s website has a lot of helpful information about what they do and what they value.

2) Prepare for the STAR Method: Tell Your Stories the Right Way

- Situation: Describe a specific event or problem you faced at work or school.

- Task: What was your responsibility in this situation? What were you trying to do?

- Action: Explain the steps you took to solve the problem or complete the task.

- Result: What was the outcome of your actions? Did you succeed? What did you learn?

- Get ready for questions like: “Tell me about a time you dealt with a difficult customer.” Or “Describe a project you’re proud of.”

3) Dress Professionally: Look Your Best

- Wear a suit or formal clothes: Make sure your clothes are clean, pressed, and fit well.

- Be well-groomed: Get a haircut if you need one, and make sure your nails are clean.

- Pay attention to details: Shine your shoes, and check that your clothes don’t have any loose threads or stains.

4) Practice: Get Comfortable Talking About Yourself

- Ask a friend or family member to help: Have them ask you common interview questions so you can practise your answers.

- Record yourself: Listen to how you sound and make any changes if needed.

- Practice in front of a mirror: This will help you see how you look when you’re talking.

5) Ask Thoughtful Questions: Show You’re Interested

- Write down some questions ahead of time: This shows you’ve done your research and you’re thinking about the job.

- Ask about the role: What are the day-to-day tasks? What are the biggest challenges?

- Ask about the company: What is the company culture like? What are the opportunities for growth?

- Avoid questions you could easily find the answer to online.

6) Follow Up: Say Thank You

- Send an email within 24 hours of your interview: Thank the interviewer for their time and say you’re still interested in the job.

- Mention something specific from the interview: This shows you were paying attention.

- Keep it short and professional: You don’t need to write a long essay.

Conclusion

This comprehensive guide equips recruiters with the latest insights into HDFC Bank interview questions and expected answers. With this knowledge, recruiters can assess candidates effectively and make informed hiring decisions.

A successful hire strengthens the bank’s workforce and contributes to its continued success in the competitive financial industry.

Remember, well-prepared candidates often become valuable assets. Use these resources to ensure a fair and insightful interview process.

HDFC Bank Interview FAQs

1) What are the interview questions asked in HDFC Bank?

HDFC Bank interviews are typically focused on your knowledge of the bank, your banking experience, and your motivation for joining HDFC. Here are some common questions you might encounter:

- Tell me about yourself.

- Why do you want to join HDFC Bank?

- What do you know about HDFC Bank’s products and services?

- What is your understanding of customer service?

- How do you handle stress and pressure?

- What are your career goals?

- Tell me about a time when you had to deal with a difficult customer.

- How do you stay updated with the latest banking trends?

2) Why do you want to join HDFC?

When answering this question, highlight your research on HDFC Bank and how its values and mission align with your own career goals. You can mention specific aspects of the bank that you admire, such as its customer-centric approach, innovative products, or strong reputation.

3) Is HDFC interview tough?

The difficulty of HDFC interviews can vary depending on the role and your experience. However, you can prepare by researching the bank, practicing common interview questions, and demonstrating your knowledge of banking concepts.

4) What is the main work of HDFC Bank?

HDFC Bank is a leading private sector bank in India that offers a wide range of financial products and services. Its main areas of business include:

- Retail banking: This includes savings accounts, current accounts, loans, credit cards, and wealth management services.

- Wholesale banking: This involves corporate banking, treasury operations, and investment banking.

- Rural banking: This focuses on providing financial services to rural communities through branches and ATMs.

- Digital banking: HDFC Bank is a pioneer in digital banking, offering online and mobile banking services, UPI payments, and other digital solutions.

By understanding the main work of HDFC Bank and preparing for common interview questions, you can increase your chances of success in your interview.